More than two decades after Awaken the Giant Within hit the top of the bestseller lists and brought his advice to millions, Tony Robbins returns with Money: Master the Game: 7 Simple Steps to Financial Freedom (Simon & Schuster), which hits stores November 18th.

Robbins certainly wasn’t kidding around when he came up with his list of go-to financial minds. The book incorporates the advice of Carl Icahn, Warren Buffett, Jack Bogle, Ray Dalio, Charles Schwab, Paul Tudor Jones, Mary Callahan Erdoes and Steve Forbes. Yet Robbins promises that Money: Master the Game will deliver a blueprint for anyone to achieve financial success, from college graduates to the most sophisticated stock investors.

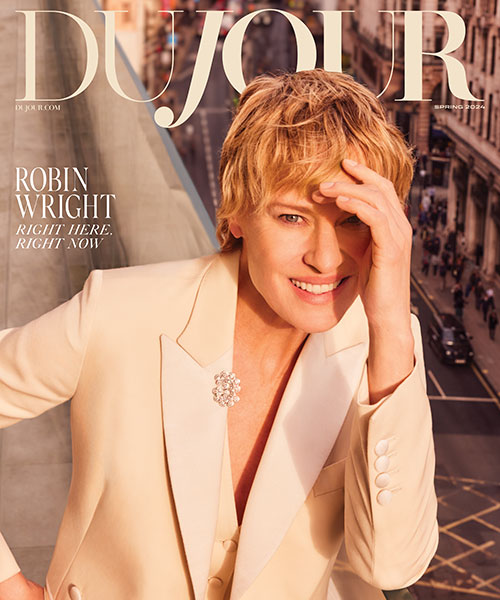

In this frank interview with DuJour, Robbins lays out his master plan.

What inspired you to write this book now?

I haven’t written a book in two decades. Part of that is because I travel about every four days and see a quarter of a million people every year in 15 different countries, and I like my multiple day jobs, but also writing is a bear. But what pushed me over the edge was seeing so much suffering happen in 2008. I grew up in a pretty tough environment and witnessing people around me going through extraordinary suffering, losing their homes, their entire financial nest egg, and unable to send their kids through college—it broke my heart.

When nothing had been improved two years later, in 2010, I started to get angry. My personal tipping point came when I watched the documentary Inside Job, narrated by Matt Damon, which eventually went on to win an Academy Award. If you haven’t seen it, basically they run through how a small number of people systematically almost blew up the world economy, and how the punishment they received was to have all of us bail them out with our tax dollars and put them in charge of the economic recovery. At the end of the film, you have one of two emotions—you’re either extremely angry or depressed because there are no solutions. I was angry. I decided I could help create solutions because I had unique access.

For 21 years, I’ve coached Paul Tudor Jones, one of the greatest financial traders in the history of the world. I’ve been beside him over the decades, watching him make money every year for 21 consecutive years no matter what the environment. Through the tech crash of 2000, the aftermath of 9/11, the 2008 world economic crisis, and through the recent massive drop in gold.

I made the decision to interview 50 of the most brilliant financial minds in the world, from self-made billionaires to the top hedge fund managers to Nobel Laureates. My mission: Find out how anyone, regardless of income level or stage of life, can move from where they are today to where they want to be financially, and make the game of money winnable for them and their family. I also wanted to know, what do the best in the game know that the rest of us are missing?

In your book, you say that the economic turn in 2008 was intense for you to watch. Do you think we learned the necessary lessons from it?

In my opinion, no, we haven’t. The same underlying challenges are still here. We’ve just put off dealing with those challenges and instead have created an artificial economy through the Fed’s printing of money, or more accurately, through the Fed adding digital zeroes to banks accounts.

How did you choose the financial experts in your book? And how easy was it to interview them?

I started with Paul Tudor Jones because of his extraordinary track record of 21 consecutive years of always making money. In fact, his company’s largest fund has 28 years of consecutive successes. Next I looked for, who is the largest and most respected hedge fund in the world? Of course that’s Ray Dalio of Bridgewater & Associates. He’s produced a 21 percent return for 23 consecutive years before fees. Absolutely extraordinary. He’s the person that governments go to, to manage their money, from China to the largest pension funds. In fact, 10 years ago it took a $5 billion net worth and $100 million initial investment to get in to visit with him. Don’t even try it now; he won’t take your money no matter who you are. I got Ray to share with me the specific strategies and even a portfolio he designed that previously was only available to his multi-billion dollar clients.

What was the wisdom that surprised you most?

Two things. Number one, their total obsession with not losing money. You would think that these people would be more focused on making money, but what they all know is they’re going to be wrong, and when they are wrong, they’re going to need to protect themselves because they know that losing 50 percent requires you making 100 percent to get even. That takes years, risk and capital. So they’re obsessed by it.

Secondly, most of these individuals are not huge risk takers. What they are is obsessed with getting Asymmetrical Risk/Reward. What does this mean? Simply, that they want to take the least amount of risk humanly possible for the largest percentage of upside. As an example, what’s made Paul Tudor Jones incredibly successful is evaluating his investments from what he calls a 5:1 ratio. If he’s going to invest a dollar, he wants to be certain that he’s going to make at least five dollars. He also knows he’s going to be wrong more often. So if he risks a dollar trying to make five and he loses, he can now risk another dollar and still make five and be far ahead. He can be wrong 3 out of 4 times and still be in great shape.

Another example is Kyle Bass, who is famous for taking $30 million and converting it into $2 billon in the middle of the subprime crisis, one of the worst economic times in our lifetimes. How did he do it? People say he’s a genius. He is a genius, but his greatest genius is asymmetrical risk/reward. He only risked 6 cents to make a dollar. In other words, he can be wrong 15 times and still make money! And he wasn’t wrong 15 times, which is why he developed such an extraordinary track record.

The average person by contrast risks a dollar hoping to make 10 to 20 percent. If you’re wrong, you’re deep in the hole and it’s going to take a long time to get it back. Finding those small risk, big reward opportunities are what great investors live for.

Can you explain why anticipation is the ultimate power?

Losers react. Leaders anticipate. If you’ve ever had the totally humiliating experience of playing a video game against a child, you know that the child always wins. Why? Because they’re faster, smarter, brighter? No, it’s because they’ve played the game before. They’ve played it so many times, in fact, that they know that the first bad guy is going to come from the left, the next one will pop out on the right, the next one will be above you, and they’re able to anticipate. If you’re an adult playing the game for the first time, you get wiped out in the first few seconds because you’re trying to figure out where things are. You’re reacting, they’re anticipating. When you know the road ahead, you have the ultimate advantage.

What do you think holds people back from seeking financial freedom?

I think many people seek financial freedom, but they fail to execute. The reason is, the world we live in makes finance look so complex. I often say, Complexity is the enemy of execution. When we’re not sure what to do, when we’re overwhelmed, we do nothing. That’s why this book is so important. I’ve taken the smartest minds in the financial world and reduced it to the common seven steps that they take to go from where you are today to where you truly want to be financially. I break through all the jargon, to show you exactly what things really mean and how you can be in charge of your own financial world. You have to become an insider, because if you don’t know the rules of the game, we all know what happens. When a person with money meets a person with experience, the person with experience ends up with your money and you end up with the experience.

How hard will it be for most people to follow the seven steps to your book?

It is incredibly simple. In fact, the book can easily be absorbed by deciding you’re going to read a chapter a day, or if you’re aggressive like me, you’ll absorb the whole thing in a weekend and get to work. Plus, I’ve developed a free app that comes with the book, to keep you on target and to remind you to follow through on the simple steps and give you what you truly deserve in life—financial freedom.

DuJour Executive Editor Nancy Bilyeau is the author of an award-winning trilogy of novels.