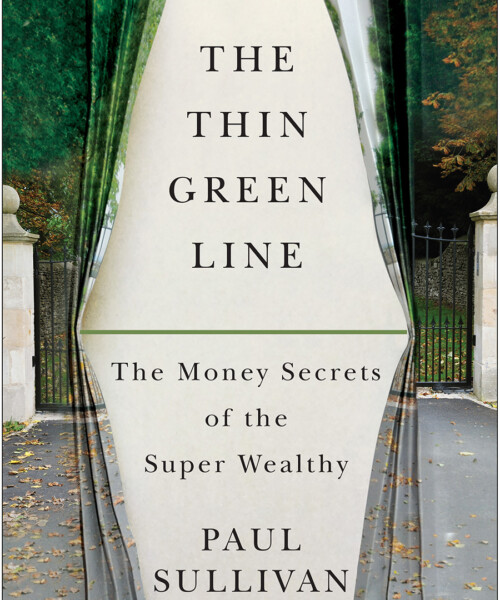

The New York Times “Wealth Matters” columnist Paul Sullivan adamantly believes that even “rich” people may never find true wealth. His experiences with the one percent influenced his steadfast ideas about financials in new book, The Thin Green Line: The Money Secrets of the Super Wealthy. Here, Sullivan reveals the pitfalls of the many poor financial decisions he has witnessed, as well as his candid advice to young entrepreneurs.

How do you define wealth?

I draw the distinction between wealth and being rich, which to a lot of people is going to sound the same. It’s going to sound like, What the hell is he talking about? If you’re wealthy, you’re rich. Rich to me is a number. It’s a bank statement, a broker’s account, perhaps it’s a number associated with the value of your house or the price of your car, but it doesn’t give you any security. It doesn’t tell anymore about your level of comfort in life. As we saw in 2008-2009, those numbers weren’t always enough. People were pretty leveraged; people ran into a lot of problems, people had to sell things they didn’t want to sell. And that’s where I think wealth is more important. Someone who’s wealthy is able to live a life that they want to live without worrying about the choices they have to make. Life isn’t going to make choices for them; they’re going to be able to make choices themselves.

What are the top mistakes you’ve witnessed people make with their money?

The top one is probably somebody who sees money as something other than a means of exchange. That’s a mistake that makes me kind of sad. The more money you have, the more things you can buy. The less money you have, the fewer things you can buy. That is the truth. That’s what it means. It doesn’t mean it’s going to make you prettier, happier, smarter. It’s not going to allow you to make those big life decisions about your kids, about education, about your health. It’s not going to make it all that much easier. The second would probably be people who believe the present will resemble the future in some way or be better. By that I mean they make plans that will only come to fruition if everything continues to get better. They assume that their house will always go up in value, that next year’s bonus will be better than this year’s bonus and I think that gets them into a lot of trouble.

Paul Sullivan

What are some of the most shocking things that you’ve witnessed in your career?

The psychological damage done by money is so predictable. In the last chapter of my book, I talk about going to this financial therapy clinic in Manhattan, Kansas. It’s in the middle of the country, but they’re doing great research on how people deprive themselves of things when they have more than enough money, how people look to make up for a lack of money in their childhood by spending a lot, by spending more than they should or by taking jobs that will make them high earners even if it doesn’t make them happy. The predictable nature of the psychological damage done by money is disheartening that it’s so predictable, but I guess the optimistic spin is that if it is so predictable, perhaps some of these really savvy financial therapists can help people get well. I also think it’s shocking that even after 2008-2009, people still obsessively follow the stock market and think that they can control or that they can come up with some sort of scheme that will allow them only to pick winners and avoid losers. I think the best way to determine your future wealth or whether you will be wealthy is to save and invest broadly.

What is the most important thing for readers to take away from your book?

Through small, manageable changes to behaviors and slightly different decisions, they can greatly improve their chances of being wealthy as opposed to being rich or poor in their life.

Any advice for a young entrepreneur?

Don’t do it, man! Get a job! Come on! Everybody wants to be an entrepreneur. My advice is to get a job and work for five years and learn something. My advice would be stay in college and finish your degree and work on your idea at night and on the weekends as generations used to do. If the idea is really that great, you’ll be able to figure it out while you’re in school and if it doesn’t take off, you’ll at least have the backstop of a great education that will guide you through the rest of your life.

The Thin Green Line: The Money Secrets of the Super Wealthy, $27, simonandschuster.com