With the recent news of President Biden’s executive order directing federal agencies to create a strategy for digital assets like cryptocurrency and tasking the Treasury with thinking about the future of money and payment systems, the asset class is getting more mainstream. Over the past five years, about 40 million people in the U.S. have invested in, traded or used cryptocurrencies. Hollywood entrepreneurs like Reese Witherspoon, Gwyneth Paltrow and Mila Kunis are speaking out to encourage women to educate themselves about crypto and NFTs, and the New York Times recently published a standalone section on cryptocurrencies.

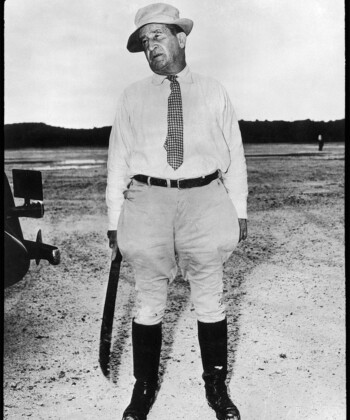

Mike Poutré

Mike Poutré, the founding CEO of The Crypto Company, one of the first publicly traded companies to invest in blockchain, has launched a specialized hedge fund to directly invest in businesses associated with distributed ledger technologies. Terraform is primarily interested in emerging vectors and opportunities in disruptive technology with a focus on blockchain, digital currencies and fintech. With more than 25 years in the banking and corporate finance industry, Poutré, along with co-founder and managing partner Ryan Fabian, is leading the charge with Terraform Capital, a Ventura County–based lifestyle fund. Fabian, a former cryptography specialist for U.S. Air Force Intelligence and the National Security Agency, technology specialist and seasoned software developer, had known Poutré for years; first as friends, then colleagues.

“Hearing Mike’s vision, I wanted to be a part of whatever he was doing,” says Fabian. “I was stepping outside the bounds of what I knew at the time to get into the entrepreneurial vertical.” Fabian now runs technology deal selection and sourcing and the Terraform fund has invested in companies like Robinhood and Elon Musk’s SpaceX. “It’s all about a democratization of capital and eliminating the middleman,” says Fabian.

“Most people have recognized that governments and financial institutions have abused the rights of currencies for a long time,” says Poutré. “It’s a natural want in this day and age. This is a new way of doing business.” For this reason, the Terraform fund invests in blockchain infrastructure. “This is helping the masses,” he says. “Everyone can benefit. We really shine in an environment where people recognize that digital assets and blockchain asset classes are those they need to be represented in.”

- Ryan Fabian

So it made sense to diversify the offerings. Terraform’s new digital assets and cryptocurrency quantitative fund, Europa, provides investors with a solid platform giving representation in this new and important asset class. Europa utilizes both smart indices and advanced digital algorithms to effectively and automatically manage volatility and risk 24/7. As a result, it can respond to market changes with lightning-fast speed, giving investors peace of mind knowing their investment is protected, managed and actively growing around the clock, 365 days a year. “Initially, we stayed away from crypto and digital assets,” says Poutré. “But now, it’s a natural segue. We noticed that the other people putting out digital assets funds are tying people up for a year, so, using technology that we helped design, we’re using a lot of the assets that we had already built to build a better product.” The Europa fund, with a minimum investment of $250,000, employs a three-pronged investment strategy targeting superior risk-adjusted returns in crypto markets: It maintains broad exposure to the largest tokens through smart indexings; its algorithmic trading models seek to generate alpha while providing some protection from bear market cycles; and it employs fundamental analysis in selecting the most promising small-cap projects.

Having both Terraform and Europa is additive to clients. “Terraform proliferates the backbone of blockchain tech, and every time we invest in a new company, it’s novel to both Mike and me in a way that is so game-changing,” says Fabian. “The systems we have in place are doing something no one has ever done: uniting disparate and separate banking systems into one global system. Every new opportunity is a powerful and novel puncture into that membrane that we’ve subconsciously created. This is just a different way of looking at the equation, and the pace of things is so fast, it’s almost daunting.”