Buzz has been swirling around Magnises, the new black card on the block. Founded by tech wunderkind Billy McFarland just five months ago, it’s poised to change the way you see credit card rewards.

“I was at dinner with friends, and they were all talking about how good of a job American Express has done marketing their higher-end cards, but at the end of the day the perks are pretty much irrelevant for someone who’s 22 through 35,” explains McFarland. “And they don’t have any networking or community aspect to it. We set out to basically change that goal.”

The company will tell you it’s less about a credit card and more about a networking community of young experience-seekers in New York. “It’s finding interesting people from all different industries—whether it’s fashion or finance or media or technology—and connecting them through a credit card that’s more relevant to their daily lives.”

Magnises—the name is completely made up—officially launched this month after a previously invite-only run and has 600 members so far. Read on to find out if it’s the right card for you:

1.

It’s actually not a credit card. It works by taking whatever credit or debit card the member already uses and activating it to the heavyweight metal Magnises card through the data on the magnetic strip. Essentially, it’s just a payment tool.

2.

It’s only for New Yorkers—for now. Though some cardholders are internationally based, Magnises is specifically focusing on New York at the time of its launch. “Right now, we’re a card for New Yorkers trying to make the most out of their life in New York,” says McFarland. “We feel like that’s something unique and something the other card providers aren’t doing.” The company has plans to branch out to other cities in the future.

3.

Eighty-five percent of cardholders are between 21 and 29 years old. But other than the young age range, there’s no typical Magnises member. “We don’t really focus on their income or occupation,” says McFarland. “It’s more about how they’re going to use the perks, what they’re going to add to the community and what value they’re going to bring to the other members. We just want people from a variety of industries who are doing all different kinds of cool stuff. We think the best vibe is to get all different kinds of people in the same room.”

4.

The annual fee is $250. The card is now open for anyone to apply, a process that involves filling out an application on the Magnises website and a phone interview. Which brings us brings us to…

5.

The perks are social life-centric. Magnises currently has over 50 partnerships, all with the goal of enhancing each aspect of a member’s daily life in mind. “We try to get things you’re doing every single day; we do everything from private drivers who are more personalized and know where you live and work, to private trainers in big gyms like David Barton, restaurants like La Esquina, Arlington Club, Omar’s, bars and nightclubs and everything in between.” The company also plans to host members-only events like chef-series dinners, happy hours, parties, even educational talks.

6.

There’s a clubhouse. The team took over a townhouse on Greenwich Avenue in the West Village to build a home base for members. The brand-new space is furnished with contemporary art and leather couches and is open all day for cardholders to “come by, bring clients or have a meeting, hang out with each other, have a drink and watch games on TV.”

7.

Its founder is a start-up whiz. Billy McFarland was starting tech companies before he began studying computer engineering at Bucknell University and is one of the youngest people to raise institutional venture capital. He left school halfway through his freshman year to start Spling, a content engagement consultancy that counts Hearst, Discovery and Universal among its clients, and founded Magnises shortly after.

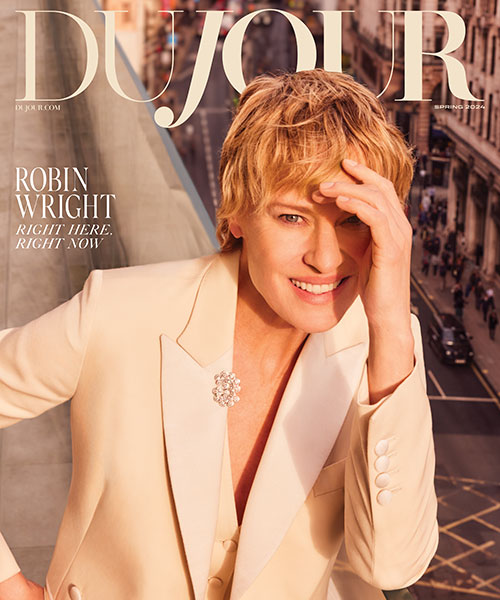

Billy McFarland and French Montana at the Magnises launch party in the Hotel on Rivington penthouse

8.

It’s backed by smart people. Magnises’ investors and advisers include Lance Weaver, the ex-chairman of Mastercard; Bill Gray, the former president and CEO of Oglivy & Mather who ran American Express’ advertising; Kevin Liles, Def Jam’s former president and CEO; as well as nightlife photographer Patrick McMullan.

9.

It’s not trying to be American Express. “A lot of our members have American Express cards,” says McFarland, “and we’re really not trying to replace them—we’re trying to work with them in a sense. Their flights and hotel perks are always going to be relevant, but we’re more about the community aspect and trying to impact our members’ lives in the city where they live.”

For more info about membership, visit magnises.com.

MORE:

The Cost of Inventing Twitter

Forget Silicon Valley: L.A.’s Start-Up Culture Is Booming

For Wall Streeters, Palm Beach Is the New Greenwich